Jump to other articles:

- Portugal Constitutional Court Ruling: What Golden Visa Investors Need to Know

- Malta Budget 2026: Key Benefits for U.S. Families & Entrepreneurs Relocating to Malta

- Malta Vision 2050: Attracting the Innovators Who Will Shape Malta’s Future

- Portugal’s Citizenship Law Frozen: What Golden Visa Investors Need to Know Now

- Italy Golden Visa & Elective Residence Visa: What to Know About 2025’s New Biometric Requirements

ATHENS PROPERTY MARKET A COMPELLING OPPORTUNITY

Athens has emerged as one of Europe’s most dynamic residential real estate markets, with new apartment prices recording sustained double-digit growth in recent years. This momentum is driven by a blend of investor capital, policy incentives, and major urban infrastructure upgrades.

Steeped in millennia of cultural heritage, the Greek capital is undergoing a striking economic resurgence that is reshaping its real estate landscape. This analysis explores the key forces behind Athens’ property market trends, offering data-driven insights for both investors and homebuyers. After navigating a decade of financial turbulence, Greece has embraced fiscal discipline and structural reform measures now yielding tangible results. Athens is increasingly seen as a rising economic and investment hub in southeastern Europe.

Athens’s new-build residential sector offers a rare combination of consistent price appreciation, macroeconomic resilience, and institutional validation. With limited quality supply, sustained foreign demand, and large-scale urban transformation projects underway, the city continues to present a compelling growth opportunity

According to the Bank of Greece, foreign direct investment (FDI) into Greek real estate reached €5.98 billion in 2024, of which over €3 billion was directed specifically into residential and commercial properties. In Q1 2025, FDI into real estate totalled €520 million, accounting for 43% of all inbound foreign investment into the country.

Capital Appreciation:

This extraordinary capital flow has been propelled by the Golden Visa program (9,411 permits in 2024), the Ellinikon smart city transformation, Europe’s largest urban regeneration project, and a surge in demand for newly built energy-efficient homes. Coupled with a limited supply pipeline, the Athens market remains in high demand among both institutional and private investors.

Greece remains one of the most investor-friendly real estate markets in Europe, offering the EU’s lowest property tax rates, no capital gains tax on qualifying property sales, and zero VAT on new developments.

Athens was recently included on Savills’ 2024 “Emerging Hotspots” list for international investors and the Knight Frank PIRI 100 Index as one of the strongest European markets for prime residential growth.

TOURISM BOOMING

The Greek Tourism Confederation (SETE) forecasts another record-breaking season for an industry that remains the country’s largest economic and employment driver. Tourist arrivals are expected to reach 27.5 million—more than twice Greece’s population. Much of this surge is attributed to the country’s strong safety record, especially as travelers shy away from destinations like Egypt, Tunisia, and Turkey following security concerns. Meanwhile, unlike Spain, Portugal, and Italy—where anti-tourism protests have erupted—Greece continues to offer a warm and welcoming environment for visitors.

According to Greece’s tourism chief, Andreas Andreadis, “The tourist industry in Greece grew two to three times faster than in Spain, Portugal, Italy or France last year. This year, we expect around 4.5 million visitors in Athens alone.”

Despite record visitor numbers, residential property prices in Greece remain approximately 30% lower than in other Mediterranean destinations, offering a unique window of opportunity for investors.

AMERICANS AMONG TOP 5 FOREIGN NATIONALITIES

According to the Ministry of Migration, U.S. citizens represented one of the top 5 foreign nationalities applying for Golden Visas in 2023 and 2024, while real estate sales to American buyers have tripled since 2019, with strong demand in coastal areas and central zones. U.S.-based investors are increasingly targeting Athens as a high-yield market with low entry barriers compared to domestic alternatives. Favorable tax treatment on capital gains, lower property acquisition costs, and Greece’s residency pathways have made Athens a preferred European gateway.

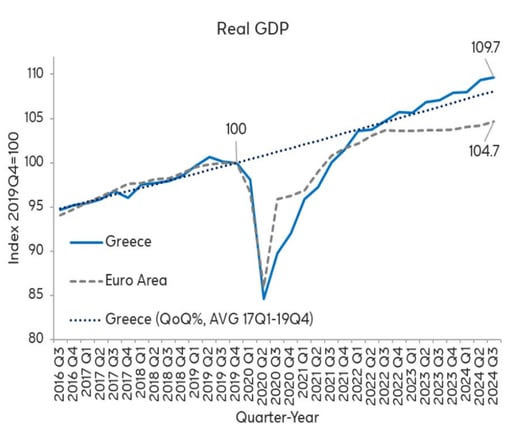

STRONG ECONOMIC GROWTH

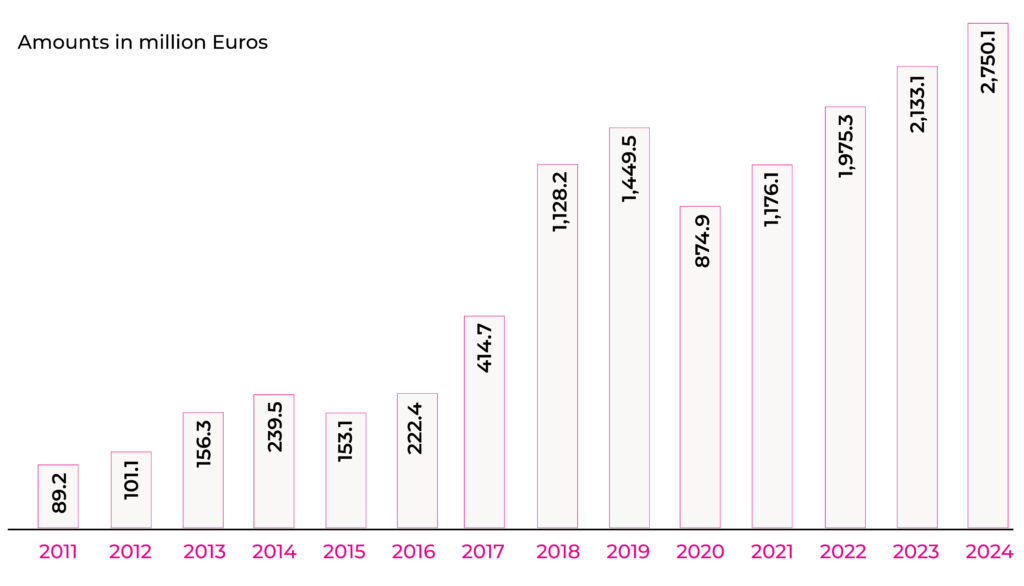

NET FOREIGN DIRECT INVESTMENT IN GREECE REAL ESTATE € Millions

Source: Bank of Greece

From modest beginnings in the early 2000s, real estate investment in Greece has surged to become the largest single component of FDI, now permanently accounting for nearly half of all net foreign direct investment. Driven by Golden Visa demand, urban development, and major deals, property has emerged as the primary vector of foreign capital, a trend expected to persist.

NOTABLE INVESTMENTS

Blackstone / HIP: Acquired the Grand Hyatt Athens in 2024 for €235 million. HIP now owns 10 Greek hotels, reinforcing its hospitality investment in southern Europe.

Microsoft: Announced a US $1 billion investment into a new AI and cloud data center hub near Athens, boosting local tech infrastructure and long-term business growth.

Four Seasons Astir Palace: Backed by Oaktree Capital and other global investors

One&Only Aesthesis (Glyfada): Ultra-luxury resort opened in 2023 with branded residences; managed by Kerzner International

Ellinikon Project: Lamda Development’s €13 billion smart city initiative attracting global partners including Hard Rock, Foster + Partners, and Brook Lane Capital

Gulf SWF’s: €820 million into the Athens Riviera, plus €620 million in central Athens and €540 million in the Cyclades. Investments are typically high-end residential, tourism infrastructure, and mixed-use projects

2025 – 2026 – ATHENS PROPERTY MARKET FORECAST

The Athens housing market is expected to remain on a growth trajectory through 2026, although the pace of appreciation may moderate compared to the previous two years. Demand will continue to be supported by international investment, limited new supply in central zones, and sustained rental pressure, particularly in neighborhoods near universities, infrastructure nodes, and coastal redevelopment areas.

Inventory will continue to be tight in 2026, particularly in the resale apartment segment. While some new development projects will be completed in the south and northeast suburbs, central Athens will remain undersupplied due to zoning, preservation restrictions, and limited land availability. Properties in renovated buildings, close to transit and education hubs, are expected to see the strongest price resilience and liquidity.

Rental prices are forecast to rise by 3% to 5%, supported by continued pressure from tourism, student housing shortages, and low availability of modern long-term lease units. Athens is forecast to retain its position as one of the most attractive European markets for yield-focused and mid-term capital growth investors.

Back to News

Back to News